Karen Tang, CFP®: Certified Financial Planner in Singapore

Do you have a financial roadmap?

Where is it leading you to?

Financial Planning

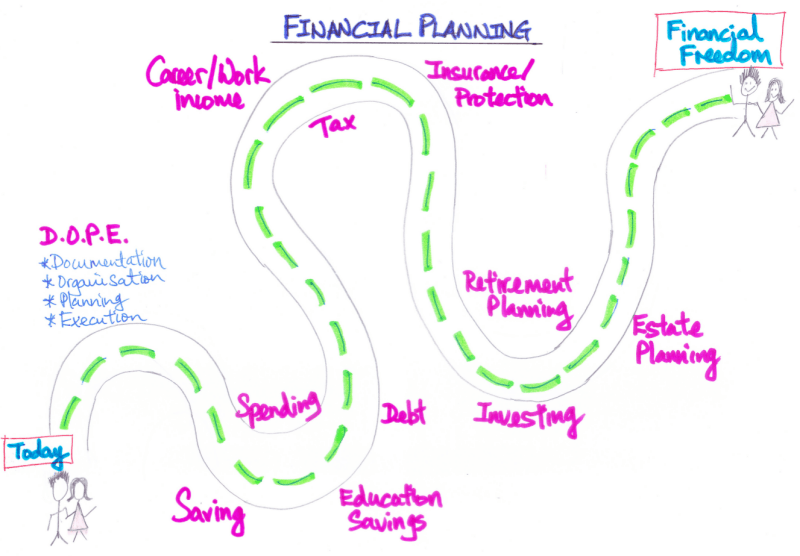

Financial planning is like navigating from point A to point B. The journey may not be all smooth sailing as challenges and difficulties could come your way. How would you maneuver around these situations to arrive safely at your destination?

A financial plan helps you to see the big picture. It provides a financial roadmap to guide you in your endeavour to fulfilling your long term life goals and aspirations. When you have a financial plan, it is easier to make prudent financial decisions and any adjustments along the way. It also helps you to stay on track to meet your goals.

The outcome of financial planning

A great financial plan does not just create enough to pay the bills; it gives peace of mind by eliminating fears and worries.

You should expect nothing less than the creation of a strategy that guides your significant financial decisions. For example, the asset allocation of your investment plans would need to be realigned on a periodic basis, and according to your risk profile that will change at different life stages. Another example is whether life insurance with cash value or term life plans is more suitable and whether early critical illness coverage makes sense. One question that I get asked often is whether buying a private property will jeopardise one’s retirement plan.

Personal financial planning is a lifelong activity

Financial planning is a dynamic process. Your goals and plans will change as you go through life. This is precisely why your financial plan will evolve to take into account new milestones in your life, new concerns and opportunities as well as threats to your financial well being. The priority given to different goals will change. For example, a plan that ensures sufficient income for young dependents is crucial for a 30 year old parent but not as much to a 60 year old grandparent.

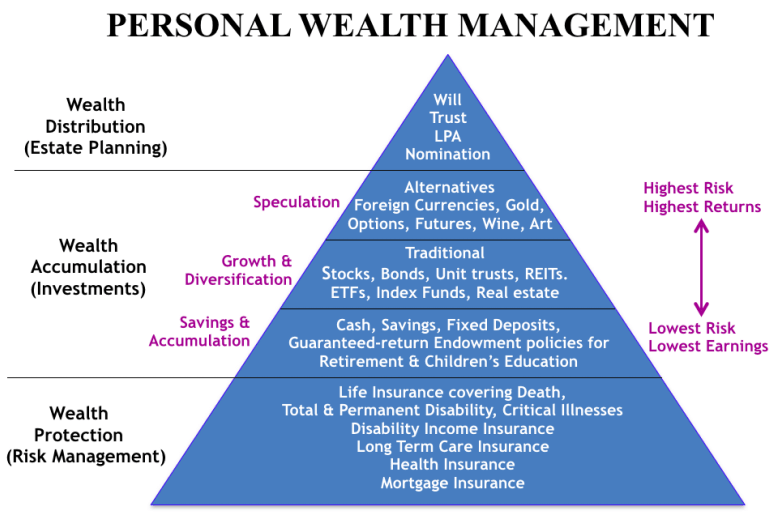

A comprehensive financial plan encompasses these 3 wealth management areas:

- Wealth Protection (risk management through insurance)

- Wealth Accumulation (building wealth through savings and investments)

- Wealth Distribution (disbursing wealth through estate planning tools & methods)

In contrast to comprehensive financial planning, specific needs planning looks at just one objective, such as funding a university education, saving to buy a home, caring for an elderly parent. Even though the goal is to achieve a specific outcome, financial planners must always consider the bigger picture to ensure long term viability.

Your financial planning is not just about you. It includes your spouse, your children, your parents.

Financial planning is not just about your concerns alone but rather it is intertwined with the long term financial well-being of your entire family as well as any business that you own or run. Risks that could have major impact on your financial security need to be factored into your financial planning. For example, we need to ensure that our parents are adequately covered under comprehensive health insurance and have adequate long term care.

What Clients Are Saying

It’s always a pleasure to talk and discuss with Karen. I have no qualms sharing with Karen my financial worries. I found the experience wonderful.

Ms. Nora