Karen Tang, CFP®: Certified Financial Planner in Singapore

8 Ratios that Will Reveal Your Current

Financial Health

Financial statements, specifically cash flows and balance sheets, can tell a lot about one’s financial position. To an even greater extent, personal financial ratios are useful benchmarks to help you evaluate your financial strengths and areas that need improvement.

These benchmarks can help you to develop better financial habits in these areas: savings, retirement, spending, investing, and debt management.

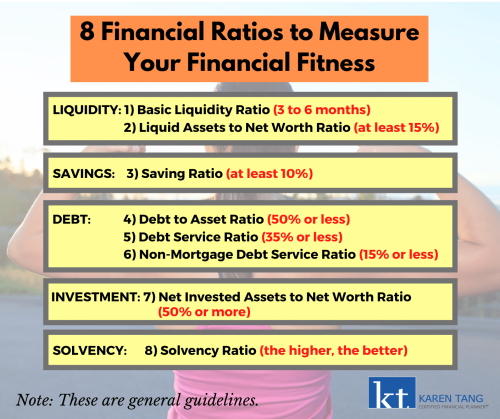

Here are eight basic financial ratios to keep in mind:

1. Basic Liquidity Ratio (= Total Cash or Cash Equivalents / Total Monthly Expenses)

This ratio tells us whether we have adequate cash reserves to meet monthly expenses in the event of an emergency like retrenchment, urgent medical treatment and for how long. This is akin to your emergency fund.

When an asset is liquid, it means that it can be converted to cash easily without any loss in value. The higher the number, the more liquid the assets are.

While it is common to use 3 to 6 months’ worth of expenses as a guideline, families with more than 2 children, free lancers, unemployed PMETs may need to set aside more. Setting aside 8 or even up to 12 months’ worth of expenses is not a far fetched idea. We have seen how a 6-month emergency fund was not sufficient for many people during this covid-19 pandemic.

2. Liquid Assets to Net Worth Ratio (= Total Cash or Cash Equivalents / Net Worth)

This ratio indicates the percentage of your net worth that is liquid i.e. in the form of cash or cash equivalents.

Why is this ratio important? Think about it – in an emergency situation, you need access to cash immediately and it may be difficult to convert one’s assets into cash within a short period of time. Hence, it is essential to have some assets in liquid form.

As for net worth, it is the difference between the assets you own and the liabilities that you owe.

Generally, a minimum ratio of 15% is safe. If you think you may be “asset rich cash poor”, check whether your ratio is meeting at least 15% of the guideline.

3. Savings Ratio (= Monthly Savings / Monthly Gross Income)

The savings ratio measures the amount of income that you set aside as savings, which could be used to invest regularly to fulfil your financial goals. Gross income is what we receive before the mandatory CPF contribution.

This ratio brings to mind the “Pay Yourself First” concept. As a general rule of thumb, you should put aside at least 10% of one’s monthly gross income. Well, I would say the more the merrier! No one will ever regret saving more.

4. Debt to Asset Ratio (= Total Liabilities / Total Assets)

This is also known as the personal Gearing Ratio. In other words, this ratio checks how much of your assets are funded by debt.

In general, it is advisable that you should have no more than 50% of your assets leveraged using debt. If one’s debt level is high, it can potentially give rise to medium to longer-term solvency issues. Solvency refers to the ability to pay one’s debt as they are due.

5. Debt Servicing Ratio (= Total Monthly Debt Repayments / Net Monthly Income)

The debt servicing ratio calculates the amount of net income that is used to make regular debt repayments. Net income is also known as “take-home” income, which is after CPF contributions.

As per the general guideline, a ratio of 35% or below indicates there is sufficient income to fulfil monthly debt repayments. Start reducing your debt to less than 35% today if you don’t wish to be a slave to debt.

6. Non-Mortgage Debt Service Ratio (= Total Non-Mortgage Debt Repayments / Net Monthly Income)

Non-mortgage debts are usually not good debts.This ratio measures how much you use your take-home income to service non-mortgage debt repayments such as credit card debt, personal loan, car loan, renovation loan and other non-mortgage related debt.

Do you know that the effective interest rates of all these debts are much higher than a mortgage loan?

If you are in financial distress and facing difficulties in clearing your debt, you should focus on this area immediately! As a general rule of thumb, you should have no more than 15% of your net income going into non-mortgage debt.

A high ratio would mean that you have borrowed excessively to fund your lifestyle expenses as opposed to long-term investments.

7. Net Investment Assets to Net Worth Ratio (= Total Invested Assets / Net Worth)

This ratio measures how much of an individual’s assets i.e. net worth are used to accumulate capital for the long-term, excluding the place of residence. As retirement approaches for some individuals, the ratio should go higher since the goal is to have enough assets for retirement.

As a general guideline, you should have at least 50% of your assets invested in some form of capital (investment) assets.

8. Solvency Ratio (= Net Worth / Total Assets)

Do you have sufficient assets to meet your liabilities? This ratio reveals the potential longer-term solvency issues of an individual i.e. it measures the probability of a person becoming insolvent or bankrupt.

As a general rule of thumb, your net worth should be at least 50% of your total assets. The higher the ratio, the better it is, as this means that the person has a strong financial position.

In Summary

Understanding our own personal financial ratios is extremely important when charting our financial journey. This clarity will help us to better prioritise the allocation of our limited financial resources so that we can achieve our goals.

Personal financial ratios also serve as measurements of our financial progress as we move along different life stages. What gets measured, gets done (and improved).

It is past the mid-year point. Where are you in terms of your financial goals? If you have not taken stock, it is time to do a review with your financial planner.

If you wish to do comprehensive financial review and get a good grasp of where you are headed, get in touch with me today!