Karen Tang, CFP®: Certified Financial Planner in Singapore

Can Insurance Be Seen As An Investment For Your Loved Ones?

Let us take a look at an example. Mr. Andrew Tan is age 35. He is married to his homemaker wife, Susie, and they have two young sons who are 3 and 6 years old.

He takes up a term life insurance policy worth $1 million, covering him for Death and Total & Permanent Disability (TPD) till his age of 80. His wife is the beneficiary. This policy costs him $2,500 per year. For around $2,000 more per year, Andrew could have a rider that provides $500,000 accelerated coverage for Advanced Critical Illness (severe stage dreaded diseases) till his age of 80.

Now, at age 45, unfortunately he suffers a severe stroke and is paralysed. Thankfully, he survives but is unable to work or live his normal, productive life. His insurance policy pays out the $1,000,000. So far, in the last 10 years, he has paid $25,000 in premiums.

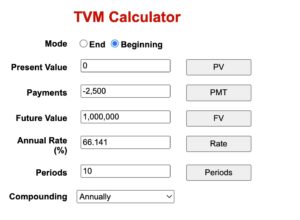

Purely from a financial standpoint, his in-flow of $1 million is 40 times the premium Andrew had paid so far. This works out to a compounding growth rate of 66.1% per year for 10 years. No other investment plan would have ensured such a large growth rate.

After 10 years:

❝ Money has value only when it is needed. Money has (real) value to us only when we need it (most). ❞

In this case, the payout comes at a time when the Tan family needed the cash flow most, because he was still in the process of building his retirement nest egg. He was 12 years short of that goal (planned for his age of 57) when this health calamity struck. That $1 million, thus, greatly reduced the financial burden and mental stress on the family.

Andrew was smart to have bought the insurance plan as soon as he could. This is because:

(a) the premiums were lower.

(b) he was still in good health, and hence, did not face any exclusions in his policy.

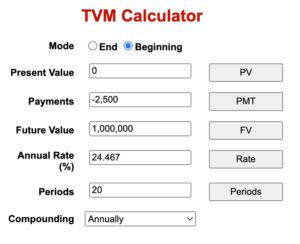

After 20 years:

Even if his stroke had afflicted him at his age of 55 (i.e. 20 years after taking up the policy), his “returns” would still have been a remarkable 24.5% compounding per year (in-flow of 20 times the premium paid till then). And 20 years is a long period of time during which any significant health condition can befall us. We have to be aware of this risk, and be fully prepared.

This is why, even for my clients who are enthusiastic investors, I refer to this example and remind them: a well-balanced insurance portfolio, if bought early enough, is one of the very best investments money can buy.

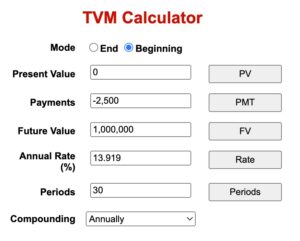

P.S. After a full 30 years of taking up the plan, i.e. at Andrew’s age of 65, still a very impressive 13.92% per annum compounding (in-flow of over 13.3 times the premium paid till then).

After 30 years:

Food for thought:

Well, you may ask what if nothing happens to me, wouldn’t I have wasted my money paying for insurance?

The overall cost of a personal calamity – mental, physical, emotional – is often far greater than the mere financial loss it entails.

So, besides being thrilled and grateful that you remained safe over the years, most of us would hope and pray that those few pennies on the dollar that we spent protecting ourselves are “wasted” i.e. never needed to be used!

CATEGORIES

KAREN'S LATEST BLOGS

Latest Blog Posts

Micro-Retirement: Rethinking Work, Money, and the Pace of Life

Recently, I was introduced to the concept of micro-retirement, that is the idea of taking intentional, extended breaks from work, ranging from a few months

Contributing to the Supplementary Retirement Scheme (SRS)? Here’s What You Need To Know

It’s the ‘SRS rush’ season once again. You have just about 3 weeks left to contribute to your Supplementary Retirement Scheme (SRS) and enjoy tax

Why Reviewing Your Critical Illness Coverage Is the Smartest Year-End Move

Before year-end, if we had to pick just one critical financial planning action most people overlook, it would be this: Review and update your insurance

One Response

This blog was… how do I say it? Relevant!! Finally I’ve found something that helped me. Appreciate it.