Room for DINKs To Up Their Retirement Readiness

I was invited to attend the media briefing for the OCBC Financial Wellness Index on 14 November 2024 held at their lifestyle branch at Wisma Atria.

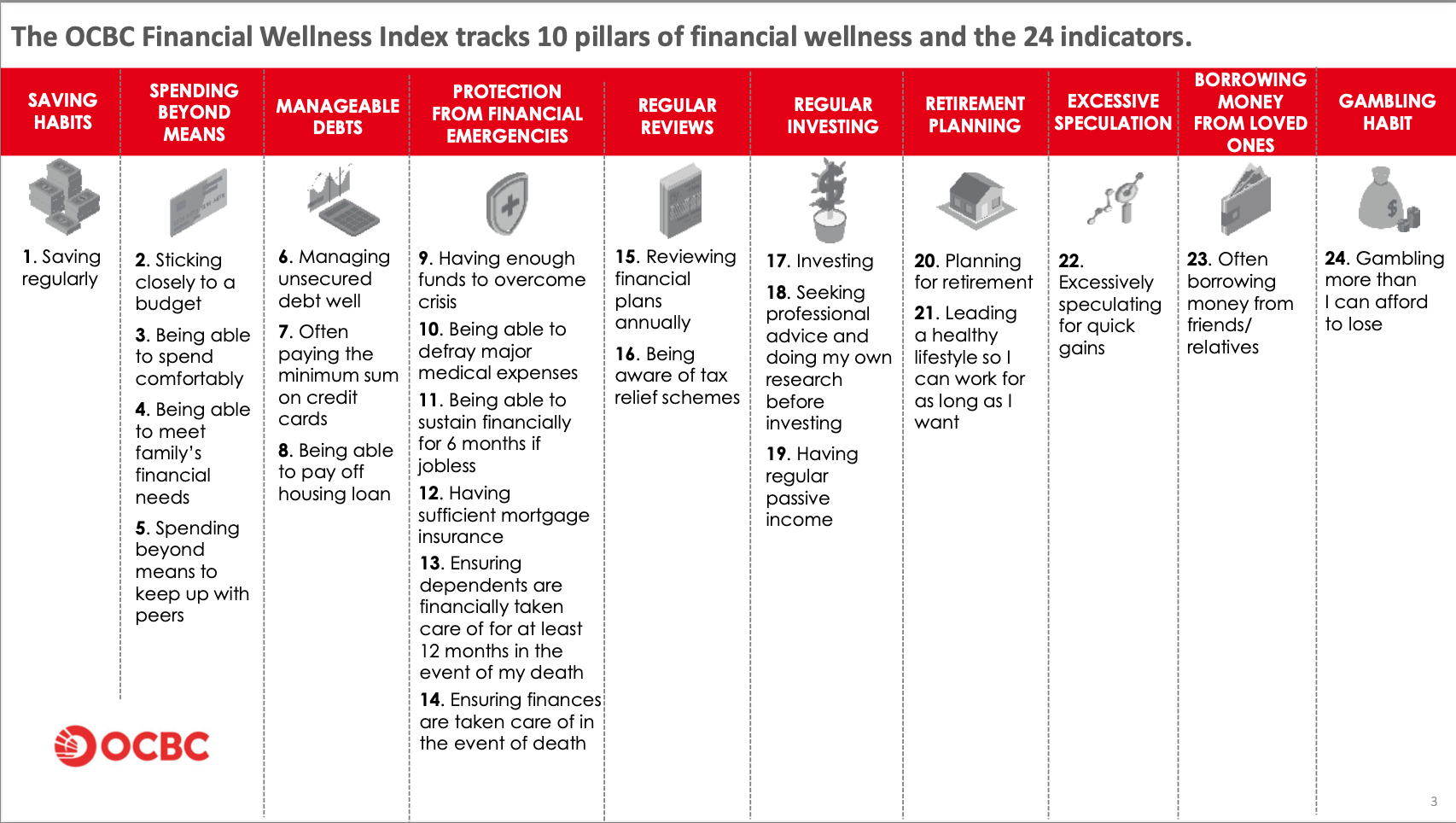

The financial wellness index tracks 10 pillars of financial wellness and the 24 indicators. See figure 1.

Figure 1

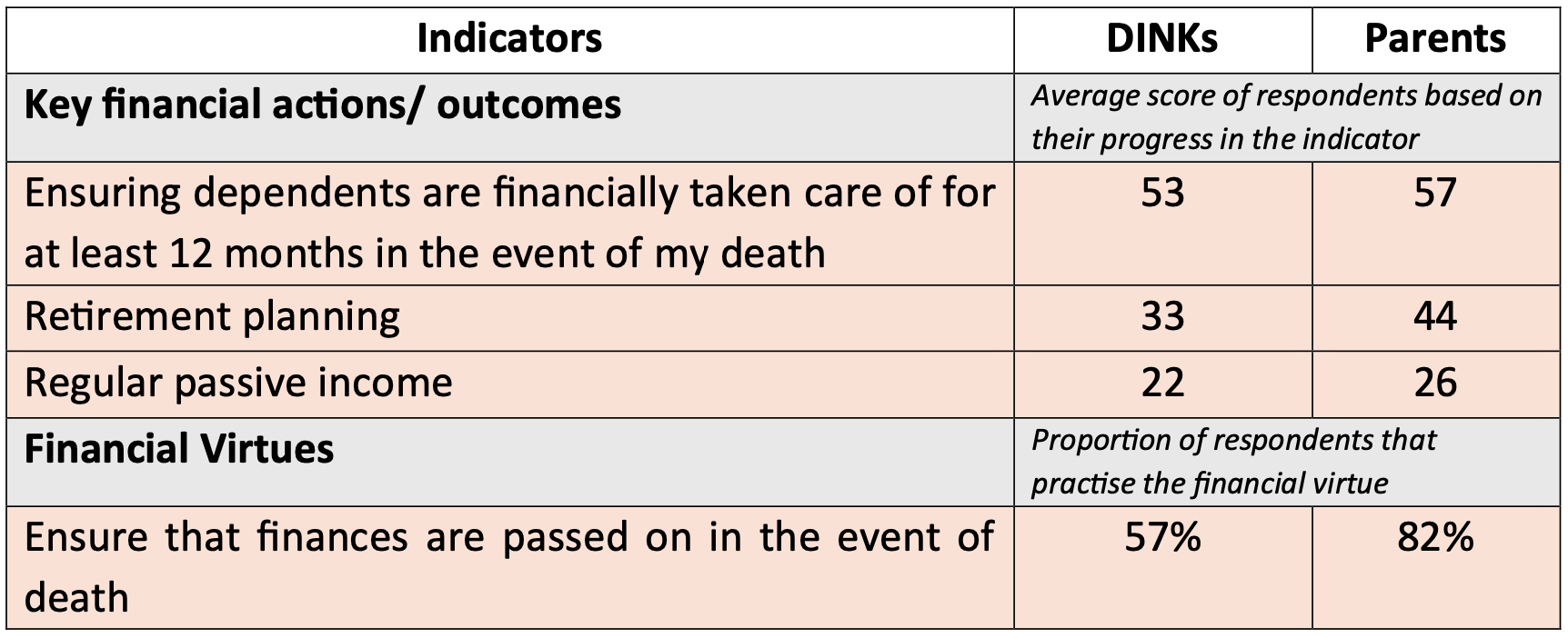

An interesting finding from the study revealed that DINKs trail parents on 8 out of 24 OCBC Financial Wellness Index Indicators. See figure 2a.

Figure 2a: DINKs fall behind parents on 8 out of the 24 indicators

Figure 2b: A summary of figure 2a

DINKs (Dual Income, No Kids) lag considerably behind parents, especially on the Retirement Planning Indicator.

This challenges the popular perception that DINKs – those who are married,

engaged or in a serious relationship, and do not have children and do not

support their partner financially – are well ahead of parents in all facets of financial wellness as they have no children to support.

Furthermore, DINKs are behind parents on all five financial virtues:

- Ensure that finances are passed on in the event of death

- Stick closely to a budget

Aware of tax relief schemes - Review financial plans annually

- Seek professional advice

Despite not having a clear and robust retirement plan in place, DINKs do not want to compromise on their dream retirement lifestyles.

The data further showed that:

- 1 in 4 DINKs without a retirement plan desire the most expensive retirement lifestyle C. See Figure 3 below.

- However, almost 9 in 10 DINKs without a retirement plan (85%) underestimate the amount needed for retirement.

- They want to retire early as well – just over a third (34%) of DINKs without a retirement plan wish to retire by the age of 55, ahead of the official retirement age of 63. In comparison, only a fifth (22%) of parents without a retirement plan have such aspirations.

Figure 3: Preferred retirement lifestyle

Karen’s Comments:

DINK households might enjoy significant financial flexibility due to the absence of child-related expenses. However, if they lack a retirement plan, they could face significant challenges in the future.

Here’s why DINKs without a retirement plan need to prioritise better planning:

1. Limited Safety Net in Old Age

Without children or dependents, DINKs cannot rely on familial support in their old age. This makes it even more critical to have a robust financial safety net for health, living expenses, and long-term or aging care needs.

2. Loss of Time Advantage

Retirement savings benefit greatly from compounding interest, which requires time to grow. Without a plan, DINKs may miss out on the compounding effect, necessitating higher savings rates in later years to catch up.

3. Dependency on Fixed Income

Without a plan, DINKs may have to rely solely on CPF savings, which are often insufficient to maintain a comfortable standard of living. A lack of investment diversification can also increase vulnerability.

4. Lifestyle Inflation Risk

Dual incomes without dependents often lead to higher discretionary spending, making it easier to delay savings. A lack of budgeting for retirement may result in a sharp decline in lifestyle quality when income stops.

5. Health Care and Longevity Concerns

As life expectancy increases, retirement periods are getting longer. Medical expenses, including health insurance premiums, will increase with age, and without proper planning, managing these costs can become overwhelming.

Steps DINKs Should Take to Plan Better:

- Start Early: Begin saving for retirement as soon as possible to maximise the compounding effect. The best time to start is when a person receives his or her first paycheck. The next best time is now!

- Budget Wisely: Allocate a percentage of household income specifically for retirement.

- Invest Strategically: Diversify investments across assets like stocks, bonds, unit trusts, and real estate to hedge against risks.

- Make regular top-ups to build CPF savings: This savings will come in handy to fund basic retirement expenses, housing as well as healthcare needs. The earlier one starts, the more savings one can accumulate. Do check the applicable top-up limits at the CPF website.

- Consider Long-Term Care Insurance: Plan for potential future healthcare needs when one can no longer look after oneself i.e. when one loses his or her independence.

- Consult Financial Advisors: Tailored advice can help set realistic goals and strategies based on their dual-income scenario.

Planning for retirement is critical for DINKs to ensure financial security and independence in their later years. Proactive steps today can help avoid stress and hardship in the future.

If you wish to gain better clarity on where you are now and how you can secure your financial future, I would be happy to connect with you.

Feel free to call me at +65 6252 8500, or complete the consultation form at www.KarenTang.sg.

CATEGORIES

KAREN'S LATEST BLOGS

Latest Blog Posts

Room for DINKs To Up Their Retirement Readiness

I was invited to attend the media briefing for the OCBC Financial Wellness Index on 14 November 2024 held at their lifestyle branch at Wisma Atria.

CNA Money Mind Oct 2024 x Karen Tang – Where to Park Your Cash In a Falling Interest Rate Environment

https://www.youtube.com/watch?v=L7aG51646v0 I was recently interviewed by Channel NewsAsia for a segment on their Money Mind TV program that is aired every Saturday at 8:30pm. The

Financial Planning – A Deeply Philosophical Activity

Financial planning, at its core, is a deeply philosophical activity. Here’s how: Values and Purpose: Financial planning forces us to confront our deepest values and