Karen Tang, CFP®: Certified Financial Planner in Singapore

CPF Special Account Closure After Age 55: Navigating The New CPF Landscape

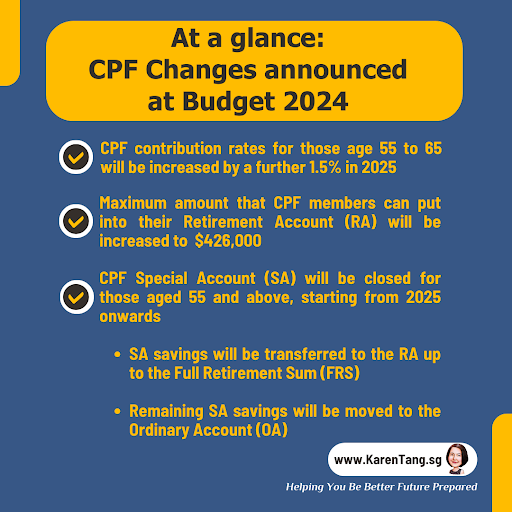

Singapore’s Budget 2024 speech by DPM Lawrence Wong on 16 February revealed significant CPF changes, in particular the closure of CPF Special Account (SA) after age 55, starting from 2025 onwards. This announcement sent ‘shock waves’ to many people, especially CPF members who will be turning 55 next year.

Starting in 2025:

- The CPF SA will be closed for individuals aged 55 and above. Any remaining funds will be transferred to the Retirement Account (RA), currently earning the same 4.08% interest as the SA.

- If the Full Retirement Sum (FRS) has been attained in the RA, funds that would remain in the SA will be diverted to the Ordinary Account (OA) which earns a lower interest.

- Individuals below age 55 will continue to keep their SA, with contributions continuing as usual.

- So at age 55, you are left with only three accounts (OA, RA, Medisave Account) instead of four accounts, regardless of how much money you have accumulated in CPF.

How does Special Account closure affect us?

Simply put, those who were depending on the higher guaranteed interest rate given by the Government on Special Accounts after age 55 (4.08% per annum) will now have two choices:

- Accept a lower (but still guaranteed) interest rate of 2.5% per annum earned in the Ordinary Account (OA) OR

- Deploy it like cash investments into diversified equities to earn a much higher rate of return over the long term.

The Retirement Account (RA) is still there. It still gives 4.08% per annum from age 55 to 65. Previously, the excess monies, after CPF ‘shielding’, could be parked back into the SA to earn the high interest rate but now it will be moved to the OA. In other words, no more ‘CPF shielding’.

These changes are making the system fairer by eliminating the loopholes that some people took advantage of, thereby also saving the Government some money that was flowing out to fund the higher interest rates.

Also, this affects those who have hundreds of thousands of dollars in their CPF, i.e. rich people, more than the average citizen.

The new Enhanced Retirement Sum (ERS)

In addition to the closure of CPF SA after age 55, the Enhanced Retirement Sum (ERS) will be raised from 3 times of Basic Retirement Sum (BRS) to 4 times i.e. $426k for 2025. A higher limit means a higher premium and it can generate more payouts from your CPF Life.

If you wish to fully capitalise on the 4.08% per annum return, then you would consider setting aside the new ERS quantum. However, you need to be aware that by moving OA funds to the RA, your money is locked-in (irreversible) to attain the return of 4.08% per annum. CPF LIFE payouts will commence from age 65 for as long as you live, unless you choose to defer the payouts till age 70.

It is crucial to be aware that while RA yields 4.08% per annum, the return from CPF LIFE may vary. CPF LIFE payouts may be adjusted to account for long-term changes in interest rates, life expectancy or mortality claims of all the CPF LIFE participants. Such adjustments, if any, are expected to be small and gradual.

Navigating the new CPF landscape

If you want to enhance your CPF returns after 55, here are 3 things you can do:

- Transfer your OA to RA to earn a higher interest but forego the flexibility (i.e. liquidity)

- Invest your OA under the CPF Investment Scheme (CPFIS)

- Withdraw your OA as cash to invest as there are many more options out there in the market

To sum up

- The CPF structure may evolve with time. During the course of say, the next 20 years, the CPF structure may differ from today’s.

- As for interest rates, “the Government will continue to ensure that the CPF interest rate pegs remain relevant in the prevailing operating environment while taking into consideration the longer-term outlook.” In other words, CPF interest rates could also change.

- Consider this a wake-up call to pay closer attention to your wealth and investment. If you’re putting all your eggs in one basket, it is time to rethink how you can secure additional sources of retirement income.

Question: So, how do you respond to these changes?

Answer:

Review your retirement plan again with these updates in your calculations. Seek professional advice and guidance from a Certified Financial Planner.

Reassess your Special Account topping-up strategy, recognizing that these funds will ultimately transition to the Ordinary Account.

Strike a balance between liquidity and returns for your CPF savings post-55. Explore alternative investment avenues and fine-tune your asset allocation, given the absence of the 4% return from the Special Account.

These decisions may pose challenges, but fear not! Tailored solutions abound to cater to your unique circumstances and aspirations. We must remain adaptable amidst the constantly evolving financial environment and be open to new strategies. As I always share with my clients, financial planning is a dynamic journey rather than a static one.

Retirement planning is not a DIY project. It can be complex, including blind spots that you may not even be aware of. If you do not have a retirement plan, then let’s get started right away!

Your retirement is (probably) the longest holiday you’ll ever take. Just like how we spare no effort in planning for an extraordinary holiday, make your retirement an exceptional one.

Reach out for a complimentary consultation today! Feel free to connect with me at +65 62528500 or email me at karen@karentang.sg

Have a wonderful week ahead!

CATEGORIES

KAREN'S LATEST BLOGS

Latest Blog Posts

Financial Coaching:Why It’s Becoming Essential in Singapore

Let’s face it – living in Singapore is expensive. Between the rising costs of housing, daily living, and societal pressures to “make it,” it’s easy to feel overwhelmed when it

Secure Your Legacy: Estate Planning Essentials for Women in Singapore

When it comes to planning for the future, estate planning often takes a backseat to more immediate financial goals, such as saving for a home or preparing for retirement. However,

2025: The Year You’ve Been Waiting For!

Happy New Year, my dear friends! Wishing you a wonderful beginning to 2025—a year filled with boundless opportunities and meaningful experiences! Starting the year on a positive note means taking