Karen Tang, CFP®: Certified Financial Planner in Singapore

How Much Of Life Insurance Do You Really Need?

Everyone needs insurance, whether you are a young working adult, a new parent, a homemaker, or a retiree.

According to the Life Insurance Association (LIA) Singapore, the mortality protection gap represents the financial gap to cover dependents’ needs such as outstanding mortgage and car loans, children’s needs such as education savings and living expenses, and funeral costs over a definite period in the event of death.

It estimated that the average protection needs against the death of a working adult with at least one dependent amount to roughly 9 to 10 times the person’s annual earnings. This, of course, will vary from person to person.

It also says that people need coverage to provide for family needs during the assumed recovery period of 5 years for a critical illness or until the insured person can return to work or adjust their lifestyle needs. But Singaporeans have only met a fraction of this.

Quantifying Your Life Insurance Coverage: Death Benefit

How do you calculate the loss of economic life value or human capital? How much life insurance do you and your family need? Being underinsured is a risky situation – in the event of an unforeseen accident or illness, you can lose the ability to work for an extended period of time. Needless to say, this has repercussions on your finances.

The Simple Rule-of-Thumb

In the past, this quick and easy method is used to determine death needs. You multiply your annual income with a factor ranging from 10 to 15. For example, if you earn $80,000 a year and a factor of 10 is used, this works out to $800,000.

But this is too simplistic given that there are other important considerations. What about the ongoing living expenses of your spouse, children, and parents, future obligations when you are no longer around to provide for them? Hence, a more comprehensive approach needs to be used to determine the death benefit.

The More Realistic Computation

This is a systematic way to derive your death insurance needs. It is mathematically sound and best of all, it takes the guesswork out of it. There are 2 things to consider here: your financial obligations to your dependents and your current resources.

Part 1: Financial Obligations

a. Liabilities

This could include:

- Mortgage

- Car loan

- Personal loan

- Outstanding income tax

- Unpaid credit card bill

- Funeral expenses

b. Future living expenses of your dependents

If you have no dependents, then there is no need to plan for this provision. However, if you have dependents, you would need to determine their living expenses so that they can still maintain the same standard of living after your demise. This amount will be multiplied by the number of years to support them.

For example, You currently contribute $4,000 to your family’s expenses and you give your parents a monthly allowance of $1,500. You estimate that you will continue contributing for another 15 years until your kids join the workforce. As for your spouse and aging parents, you assume their life expectancy and calculate accordingly.

c. Child’s university education

As the cost of education increases with time, it is prudent to start saving early. How many children are you supporting? What field of study (medicine or non-medicine) would you like to set aside money for and do you wish to plan for 3, 4, or 5 years? If you intend to get education savings plans for this purpose, then you need to factor in the premiums.

d. Lump-sum gifting, if any

It is not uncommon for people to gift a lump sum to his or her favorite charity, loved ones, and even beloved pets.

e. Your death insurance need

You can now add sections a, b, c and d to derive the amount of death benefit you require.

Part 2: Your Available Resources

If you need $1,000,000 to provide for your dependents and you already have the resources to do so, then you need not get any more life insurance (death benefit). But, if there is a shortfall, you should close the gap immediately.

Note: Even when available resources are greater than the protection needs, it is still advisable to transfer the risk (partially or even 100 percent) to the insurers. Would you rather exhaust your resources and self-insure when it is more cost-efficient for the insurer to take over the risk?

Your available resources come from:

a. Your existing insurance coverage

Consolidate and note down the coverage you have from:

- Your own insurance policies – for example, Dependent Protection Scheme (DPS by CPF), Home Protection Scheme (HPS by CPF)

- Your policies bought through insurance agents and banks

- Your employee benefits (company insurance)

b. Your current assets

They are your:

- Bank savings

- Fixed deposits

- Investments – for example, shares, unit trusts, investment property

- CPF monies (balance of Ordinary, Special and Medisave accounts)

c. Your total available resources

Add sections a and b to arrive at the total available resources.

Part 3: Compute your death insurance needs

To determine whether you have a shortfall or surplus in your death insurance, subtract the total available resources from the total insurance requirements.

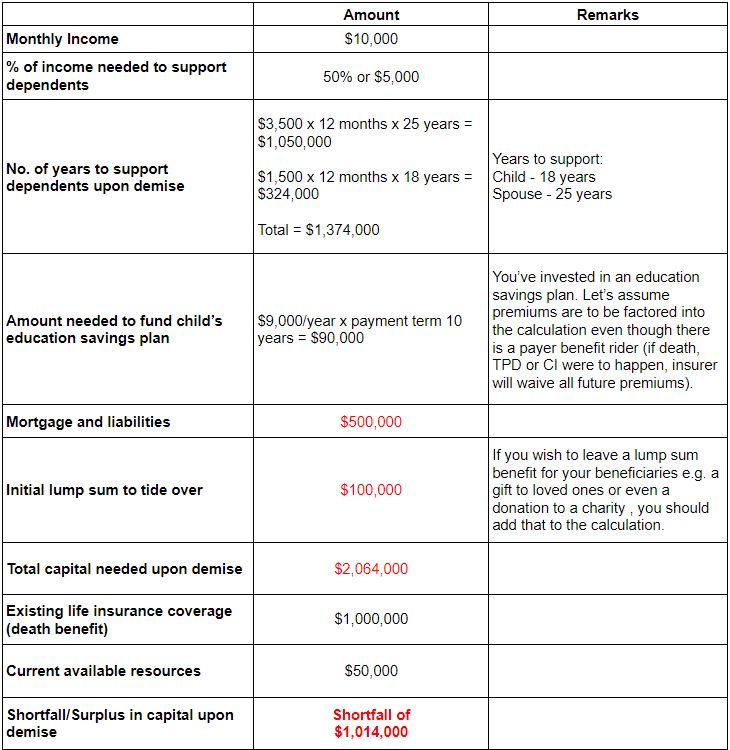

The table below is a good starting point to help you estimate how much death insurance cover you need.

Example: Computation of Life Insurance Coverage – Death Benefit

Calculating Your Life Insurance Coverage Need: Total & Permanent Disability Benefit (TPD)

What happens if you become permanently disabled from a car accident? How much would you need to support yourself and your dependents?

Most people would give me a blank look because they have no real answer to this.

The truth is, besides the usual living expenses, there will be additional medical-related expenses to take care of.

A disabled person will need medication, regular medical consultations, regular rehabilitation sessions or therapies, and a caretaker to watch over him. And not to forget that there would be medical bills to pay off as well.

Here is a list of possible monthly living expenses if you suffer from a permanent disability:

- Medication ($100)

- Maid/nurse ($1,000)

- Medical consultation ($400)

- Rehab therapy ($600)

- Transportation ($200)

- Initial lump sum to tide over immediately after the accidental event ($100,000)

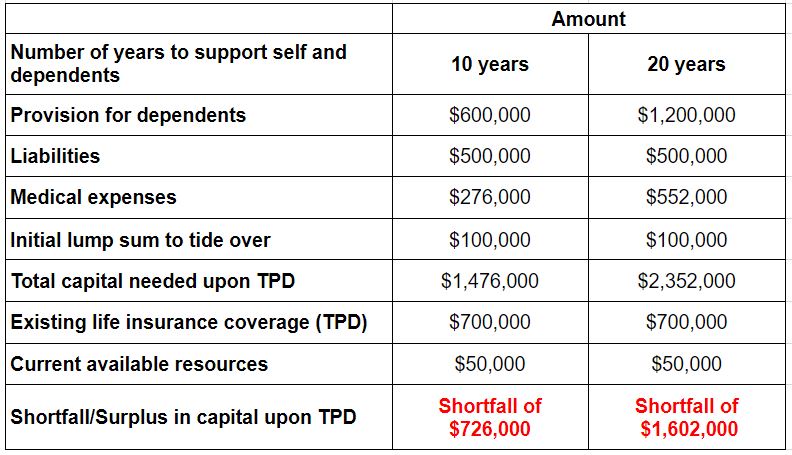

The extra monthly expense works out to $2,300. This is a conservative estimate as to the monthly expenses and initial lump sum for treatment are expected to be much higher. Also, think about the possibility of living another 10 to 20 years.

Example: Computation of Life Insurance Coverage – TPD Benefit

Calculating Your Life Insurance Coverage Need: Critical Illness (CI) Benefit

LIA published the “2017 Protection Gap Study – Singapore” in April 2018. The protection gap is a metric to estimate the lack of protection against the financial consequences of specific events such as death or critical illness.

When there is a CI protection gap, it means there is a shortfall in protection. In calculating the shortfall, we assume that the CI recovery period is 5 years and that the individual is unable to work during the entire recuperation period.

The study revealed that the critical illness protection gap is at an overwhelming 80% as compared to the mortality (life) protection gap of 20%. Singaporeans are greatly under protected on this front.

Even before this study was published, I have been applying this rule to derive critical illness coverage: Annual Expenses x 5 years.

Given that the top 3 killers in Singapore are cancer, heart attack, and stroke, and when the likelihood of recurrence is fairly high, it is unlikely that the patient can resume full-time work. Even part-time work can be a real challenge.

Protect Your Wealth Before You Invest

Wealth protection is fundamental in helping you weather unforeseen circumstances that would otherwise have a detrimental effect on your long term financial wellbeing.

Remember this – it takes only one accident or a major illness like cancer to deplete your life’s savings. Do not choose the cheapest policy available or dismiss insurance entirely. The right amount of coverage and the right type of solutions will stand you in good stead.

One Final Thing

Don’t forget to reassess your financial needs from time to time. Life is never static, and it is important to revisit your past financial decisions to evaluate if they are still sound. You can consider having a review once a year, or perhaps even using milestones such as the birth of a child as the impetus to reassess your financial standing.