Is the Supplementary Retirement Scheme (SRS) Worth Your While?

What is the Supplementary Retirement Scheme?

The Supplementary Retirement Scheme (SRS) is a voluntary saving scheme to encourage individuals to save for retirement, over and above their CPF savings. As a sizeable portion of CPF money is often used for the down payment and to service mortgage loans, we could consider alternatives such as SRS as a supplementary source of our retirement nest egg.

Contributions to SRS are eligible for tax relief. You can choose to contribute to your SRS contribution cap before 31 December every year and enjoy tax relief in the following Year of Assessment.

Saving on income tax is the biggest appeal of the SRS account for Singaporeans, PRs, and foreigners. Every dollar you put in your SRS account is tax-deductible, up to the contribution cap.

You can choose to open your SRS account with either DBS, OCBC, or UOB and you will earn the standard 0.05% p.a. return as you would with a regular bank savings account.

How much can you contribute to SRS?

Currently, the maximum you can contribute each year is $15,300 for Singaporeans and PRs and $35,700 for foreigners.

There is no need to indicate your tax return in order to get your SRS tax relief. The bank administering your SRS account will report directly to the government and your tax relief will be computed automatically.

Do note that there is a total personal income tax relief cap of $80,000. This includes SRS contributions and anything else that entitles you to tax relief such as Working Mother’s Child Relief and donations.

What are the benefits of contributing to SRS?

- Pay less income tax

- Investment returns are tax-free before withdrawal, only 50% of SRS withdrawals are taxable at retirement

- Instead of letting the cash in your SRS account lose its value due to inflation, you can invest the funds in government-approved instruments such as shares, REITs, ETFs, Index funds, Singapore Savings Bonds, Unit Trusts, and Endowment insurance plans.

Best of all, your investment gains will not be taxed. Similar to investing your CPF funds, the returns on your investments funded by SRS will return to your SRS account. When you withdraw your savings once you reach the prescribed retirement age (currently age 62), you will only be taxed 50% of the withdrawal amount as taxable income. - What this means – if you have no other taxable income (from employment or rental), you can withdraw up to $40,000 a year from your SRS account without paying any tax. Why? Because only 50% or $20,000 will be considered taxable income, and there is no tax on an annual income of $20,000 and below.

- Instead of letting the cash in your SRS account lose its value due to inflation, you can invest the funds in government-approved instruments such as shares, REITs, ETFs, Index funds, Singapore Savings Bonds, Unit Trusts, and Endowment insurance plans.

- Flexible contributions

All SRS members can contribute as much or as little as they want. The SRS contribution rate for Singaporeans and residents is 15% (capped at $15,300) of the income base while it is 35% (capped at $35,700) for foreigners. - Opportunity to grow your SRS to supplement your retirement income

The money in your SRS account not only provides you with tax savings, it also has the potential to grow. You can invest in SRS approved shares, unit trusts, REITs, ETFs as well as insurance plans (i.e. endowment). When considering an endowment plan, be sure to check whether your capital is guaranteed. Also, in your retirement planning, it is advisable to have more than one source of retirement income.

What are the withdrawal rules?

Since the SRS is meant to provide us with retirement income during our golden years, there are withdrawal rules that we need to take note of.

- If you withdraw any amount before the statutory retirement age (i.e. currently age 62), 100% of the withdrawn amount is taxable. Furthermore, you will be charged a 5% penalty. For example, if you withdraw $40,000, you will need to pay a penalty of $2,000.

- If a withdrawal is made before the statutory retirement age due to death or medical grounds, 50% of the withdrawal amount will be subject to income tax. There will be no penalty.

- If the withdrawal is made before the statutory retirement age due to bankruptcy, 100% of the withdrawal amount will be subject to income tax. There will be no penalty.

- If you withdraw before retirement age and not for medical or bankruptcy reasons, you will have to pay a 5% penalty, plus pay taxes on 100% of the withdrawn amount. The withdrawn amount will be added to your taxable income when calculating your income tax liabilities for the year.

- If you make withdrawals after the statutory retirement age, you will receive a 50% tax concession on your withdrawal amount. For example, if you withdraw $40,000 from your SRS account for the year, only $20,000 will be considered as taxable income. There will be no penalty imposed on the withdrawal amount.

How much can you save with SRS tax reliefs?

The main advantage of depositing money in your SRS account is the tax breaks. If you do participate in the SRS, it should be because you wish to lower your tax liabilities. For those who are earning more than $40,000 a year, the savings can be quite significant.

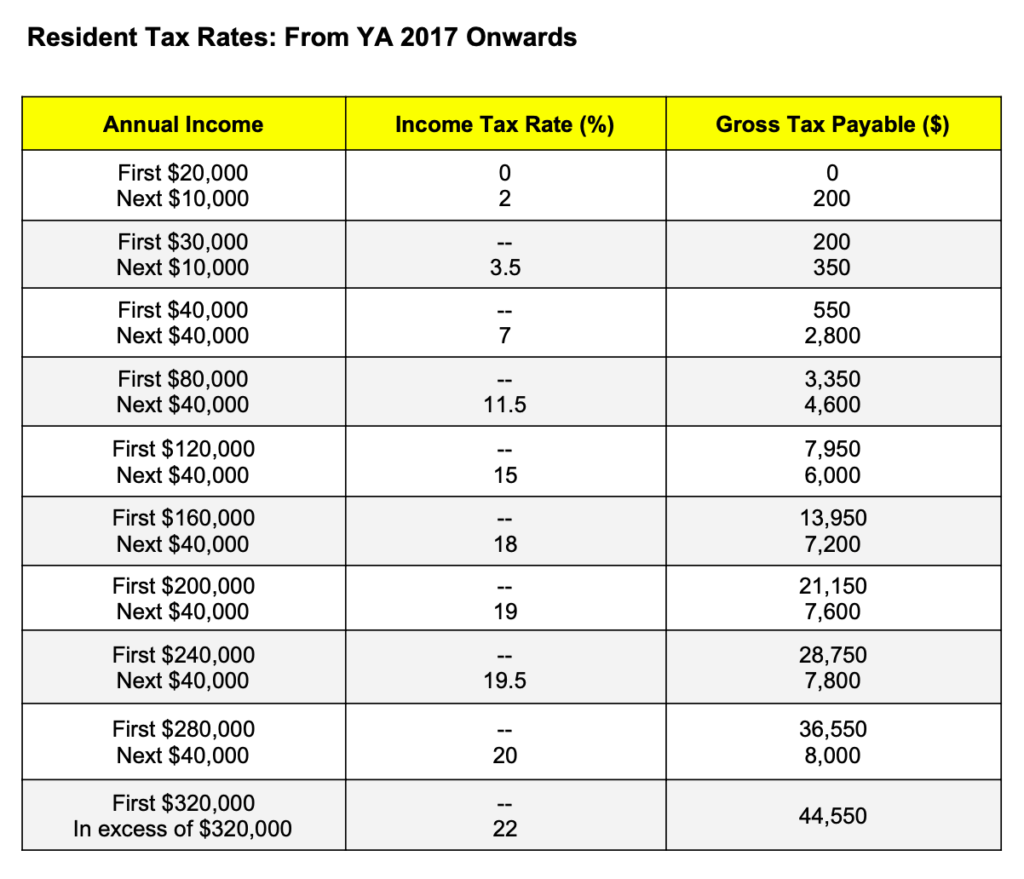

This table shows you an estimation of how much you can expect to pay in income tax each year for every dollar that you earn:

You’ll notice that there’s a significant jump once your annual income crosses the $40,000 mark. This is why it is only worth considering opening an SRS account when you earn more than $40,000 in annual income.

Let’s look at a simplified example, excluding any other tax reliefs:

Miss A earned $80,000 in 2019. She would have paid $3,350 in income tax in 2020. Early this year, she secured a new job and is now making an annual income of $90,000. This means that for the next tax season, she will need to fork out $3,350 + $1,150 (11.5% of the $10,000 increment) = $4,500 in income tax.

However, if she were to open an SRS account this year and deposit $10,000, she will enjoy a tax relief of $10,000. This will take her back to her previous income bracket, and her income tax ‘expenses’ will drop to $3,350 again. She would be saving $1,150 on income tax, which is a considerable 25%.

Is SRS worth it then?

It all depends on your income level. The first $40,000 you earn each year will incur a gross tax of up to $550. The next $40,000 you earn will be taxed at 7% or up to an additional gross tax of $2,800. Hence, your total tax payable could add up to S$3,350 if you have an annual income of S$80,000, assuming you do not have any other tax relief. Therefore, the tax rate on an annual income above $80,000 ranges between 11.5% to 22%.

Let’s look at another income level, assuming no other tax reliefs. Say you are a Singaporean Citizen or PR earning $120,000 annually. The income tax payable is $7,950. If you contribute the maximum of $15,300 to SRS, you pay $6,191 in taxes. This translates to $1,760 in savings or 22% of your tax saved.

People with higher taxable income have greater incentive to contribute to their SRS account, as they would be able to reduce their income tax by a larger amount. Of course, you do not have to contribute the maximum amount. Ideally, you should just set aside enough to get you to a lower tax bracket.

- Liquidity – Do you expect the need for lump sum cash in the near future?

The benefit of tax savings should be balanced against your need for liquidity. If premature withdrawals are made before age 62, 100% of the withdrawn amount is taxed and you will also incur a 5% penalty. Hence, you should not be contributing large sums to SRS if you have immediate or foreseeable cash needs.

Before contributing to SRS, you should have built up a comfortable emergency fund. In other words, the amount contributed should be savings you intend to withdraw for your own retirement and not money that you may need in the foreseeable future.

Two Tips

Tip #1: Why you should open an SRS account today

Based on data from the Government’s website, the statutory retirement age will be raised from 62 years old to 63 from 1 July 2022, and gradually to 65 by 2030. Therefore, you could open an SRS account now and deposit $1 to “lock-in” your retirement age first. Do not put more than that if you are not sure how you will use your SRS account to help you in retirement planning.

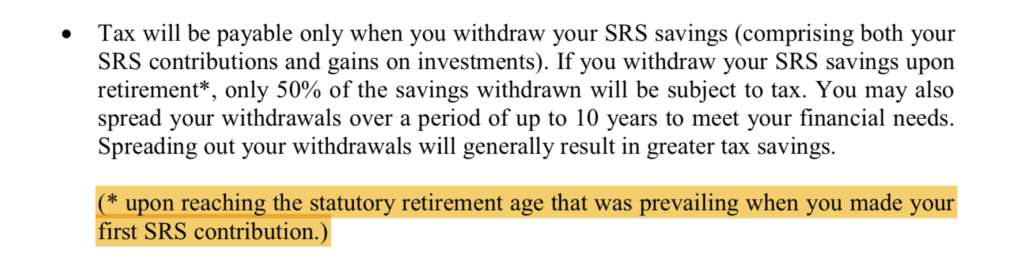

According to this paragraph which I found in a 29-page PDF document on SRS put up by the Ministry of Finance:

Source: Ministry of Finance

Tip #2: Why you should withdraw your SRS monies over 10 years (i.e. age 62 to 71) and not a lump sum

Stagger and save! To lower your taxes, consider spreading out your SRS withdrawals, instead of fully drawing down what you have saved. You can withdraw over 10 years and can determine your withdrawal amount. As you would presumably have little to no income at retirement, you may end up paying little or no tax. You can potentially withdraw up to S$20,000 a year, tax-free, over 10 years, as the first S$20,000 of an individual’s chargeable income is not taxed. Note that taxes above this sum will be payable in the following year after the withdrawals are made.

Who benefits the most from SRS?

There are three groups of people that could gain from SRS:

- Those who have started earning at least $40,000 a year, so any amount of tax relief is welcomed.

- Those who are seriously planning for their retirement, after settling their housing needs.

- Those who are already investing or planning to invest a portion of their income for retirement. Not only will they capture some savings through tax relief, but the investment returns will also not be taxed until they are withdrawn from the SRS account. Of course, like many other investments, returns are not guaranteed.

In conclusion

Contributing to an SRS account is a long-term commitment. Ask yourself whether you are willing to lock-in your money till age 62 in exchange for some tax savings. Weigh the pros and cons before deciding to open an SRS account.

If you do participate in SRS, you must invest your SRS funds or put it in an endowment policy that guarantees the capital. Otherwise, leaving it in your SRS account is no different from your savings account earning negligible interest.

Note that the Supplementary Retirement Scheme is NOT the only way you can plan for retirement. Engage a qualified financial planner to help you map out your retirement plan.

To conclude, the key reason to participate in SRS is purely for tax relief. So you owe it to yourself to do the math beforehand to determine just how much money the tax relief will save you and whether it is worth it.

CATEGORIES

KAREN'S LATEST BLOGS

Latest Blog Posts

Secure Your Legacy: Estate Planning Essentials for Women in Singapore

When it comes to planning for the future, estate planning often takes a backseat to more immediate financial goals, such as saving for a home

2025: The Year You’ve Been Waiting For!

Happy New Year, my dear friends! Wishing you a wonderful beginning to 2025—a year filled with boundless opportunities and meaningful experiences! Starting the year on

Her World Dec 2024 x Karen Tang – The Expert Guide To Achieving Money Goals

With 2025 just around the corner, it’s the perfect time to set new intentions – not only for personal growth but also to strengthen financial