Karen Tang, CFP®: Certified Financial Planner in Singapore

Which is Better - Term Life or Whole Life Insurance?

An insurance policy provides protection for financial losses suffered as a result of a particular event. Such events include death and total and permanent disability (TPD). To put it simply, a life insurance policy is designed such that if you die or are unable to work due to a disability, the benefit payout should be enough for you and your dependents to live on.

Before you buy any life insurance, you need to first understand the differences and uses of term life and whole life insurance.

How Are They Similar?

1. Provide for your loved ones when you are no longer around

Whole life insurance provides you with lifelong coverage and also offer extra support during retirement. Term life insurance, on the other hand, covers you for a shorter period, but it is less costly and simpler to understand.

Protection against death (and terminal illness) is the most basic form of coverage offered by both term life and whole life insurance. A death benefit payout can provide for your loved ones should you pass away. Your family can use the proceeds of the policy to cover funeral expenses, mortgage payments, cost of tertiary education and other day-to-day expenses.

2. Customizable to suit your needs

Both term life insurance and whole life insurance can be customized to suit your needs and budget. You can adjust the insurance premiums as well as the coverage amount. Most plans also provide the option to add riders if you wish to receive more comprehensive protection. For example, there are riders to cover you for total and permanent disability (TPD), critical illnesses (CI), and early critical illness (ECI).

If you become totally and permanently disabled, the TPD benefit will pay a lump sum. This payout can be used in any way and is meant to offer financial support to replace the loss of your income.

If you are diagnosed with a CI, the lump sum payout will serve as an income replacement as you will need to take time off from work to recuperate.

3. Fixed Premiums

Both term life and whole life insurance typically have a premium term during which you will make fixed payments. Some whole life insurance charges just one single premium at the beginning, which is suitable for those who do not wish to commit to a longer premium term. Paying premiums over a fixed term requires a certain level of commitment. Hence, you should choose an affordable premium amount and a payment structure that you are comfortable with. However, do note that CI premiums are not guaranteed. This means that the insurer can choose to increase premiums, usually as a result of claims experience.

While the death benefits of whole and term life can be similar, there are key differences between these two popular types of life insurance.

Where Are They Different?

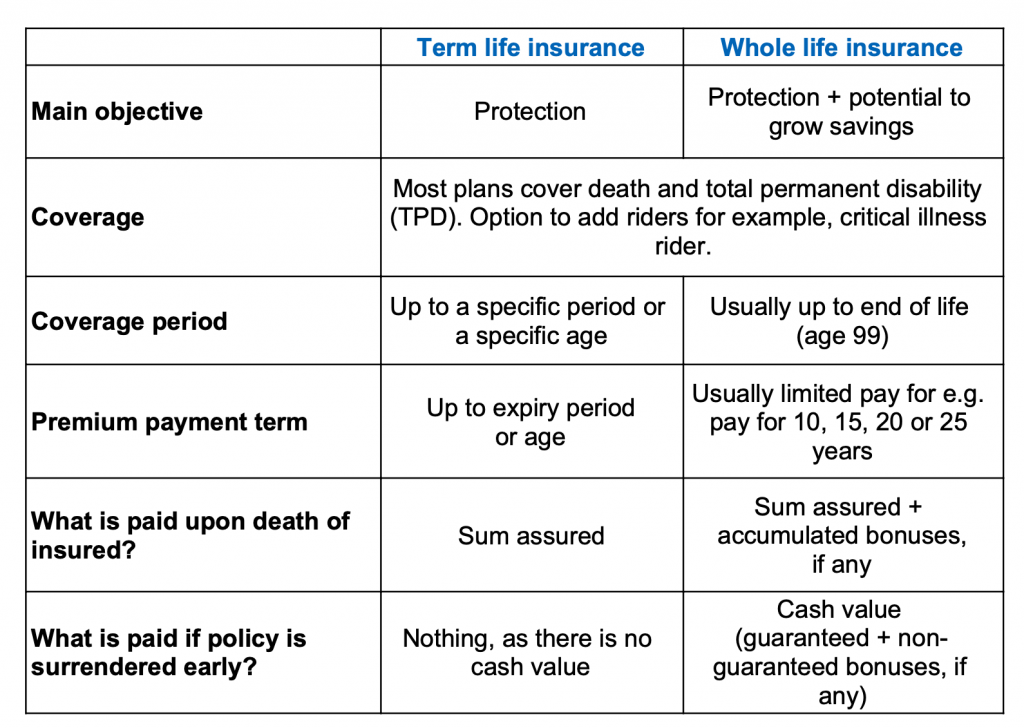

The three main differences between them are:

- How long the policy will cover you

- How long do you pay premiums for

- How much money you get back if nothing happens to

you

What is Term Life insurance?

It is life insurance that provides insurance coverage only for a fixed period. For example, you want to be covered until your youngest child completes university or is financially self-reliant. Another instance where a term life plan is suitable is when you have a mortgage commitment.

You choose the term (i.e. duration of coverage) when you purchase the plan and you pay premiums throughout the policy term. Common terms are 10, 20, and 30 years. Or you can choose the cover term to end at a specific age, for example, age 60, 70, or 80.

Term Life Insurance is also known as “no-frills” or “pure” life insurance because the premiums buy only protection and nothing else i.e. does not have a cash value. Therefore, it has a high coverage to premium ratio as compared to a whole life plan. In other words, it is a cost-effective tool that can be used to boost your coverage during your productive working years.

Term life insurance is easier to understand and costs much less than whole life insurance.

Features of a Term Life Insurance Plan:

- Choose your own time frame – 15, 25, 30 years, or even up to age 65, 100, etc.

- Pay premiums till the chosen expiry age

- Coverage stops after expiry age

- No cash value i.e. no surrender value – it has no ‘savings’ component. Hence, premiums are often the lowest relative to coverage. If nothing happens to you and you don’t make a claim, you get nothing (apart from a letter thanking you for giving them money for the last 30 years).

- Can enhance coverage with riders – Total and Permanent Disability, Major Illness, Early Critical Illness, Personal Accident

- Some plans provide the option to convert to a whole life plan before a certain age

- Some plans give the option to increase coverage without health underwriting at a key life stage event like marriage, the arrival of a baby, buying a new home.

- Flexibility to stop, change insurer as a term plan does not accumulate any cash value.

Tips:

- A cost-effective tool to close the gaps in your insurance planning.

- You should carefully consider the coverage duration of your life insurance policy and prepare for the possibility that you might outlive your policy term, that is if you are depending solely on a term plan for your protection.

- Always check your policy documents to see what protection a policy includes and excludes. The last thing you want is to have a term life policy that covers you for death but does not offer total and permanent disability or critical illness coverage.

There are 2 types of Term Life Insurance policies:

- Level Term i.e. level coverage

- Decreasing Term i.e. reducing coverage

When Should You Take Up Term Life?

Scenarios include:

- You do not have the budget now to get permanent life insurance. Some term life policies are convertible to permanent coverage. The deadline varies by policy.

- You have dependents to support, for example, your children till they graduate and are financially independent.

- You are the breadwinner of your family.

- You require additional coverage due to an increase in income.

- You require additional short-term coverage due to a sudden increase in liabilities for example, mortgage and car loans.

- You think you can use the savings from purchasing a term life policy to build a diversified investment portfolio that earns higher returns than a whole life plan.

What Is Whole Life Insurance?

Whole Life insurance provides lifelong coverage (up till age 99) and includes an investment component known as the policy’s cash value. You can borrow money against the account or surrender the policy for cash. But if you do not repay policy loans with interest, you will reduce your death benefit. And if you surrender the policy, you will no longer have coverage.

Whole life insurance premiums are much higher because the coverage lasts for a lifetime, and the policy has cash value, with a guaranteed rate of investment return on a portion of the money that you pay.

Features of a Whole Life Insurance Plan:

- Provides lifelong coverage.

- Pay premiums for a limited-term: Pay premiums for a predetermined fixed period, for example, 15, 20 or 25 years.

- Has cash value, hence, more costly than a term plan.

- Premiums generally remain the same.

- Can enhance coverage with riders (example, Total and Permanent Disability, Critical Illness, Early Critical Illness)

- Has a non-guaranteed cash value component, based on the performance of the Par fund.

There are 3 Types of Whole Life Plans:

- Participating (Par)

Pays bonuses. Upon your unfortunate demise, it pays the basic sum assured plus any bonuses accumulated. - Non-participating (Non-par)

No bonuses but has a guaranteed, accumulated cash value. Should you die prematurely, only the sum assured is paid out. - Investment-linked policies (ILP)

There are 2 types of ILPs. Upon death:- The higher of the sum assured or the value of the ILP units are paid out

- Both the sum assured and the value of the ILP units are paid out

Tips:

- Term life is sufficient for most families who need life insurance, but whole life and other forms of permanent coverage can be useful in certain situations.

- My take is that it is not so much about the type of people but rather it is based on one’s individual needs, budget and preferences.

When Should You Take Up Your Whole Life?

- When your family depends on your income – some of your coverage can be in the form of whole life insurance

- When you want absolute peace of mind during retirement years, knowing that you are financially protected

- When you have a lifelong dependent, such as a child with special needs. Life insurance can fund a special needs trust to provide care for your child after you are gone. Consult with an estate planner and financial advisor if you want to set up a trust.

- When you wish to leave an inheritance

- When you want to equalize inheritance. If you plan to leave a business or property to one child, whole life insurance could compensate your other children.

Summary: Term Life versus Whole Life

Life Insurance Is A Purchase For The Future

Some people have asked me: “Is it a good idea to cancel my Whole Life insurance and replace it with Term Life insurance?”

My reply is this: You should not cancel your Whole Life coverage unless you have fully understood all the pros and cons. Discuss with your financial planner about alternative solutions and find out how the cancellation will impact your financial plan.

The ideal time to buy life insurance is when you are young and have a clean bill of health. What is your current health status? If you have developed a health condition after purchasing your earlier insurance policies, then it is not advisable to cancel.

CATEGORIES

KAREN'S LATEST BLOGS

Latest Blog Posts

Micro-Retirement: Rethinking Work, Money, and the Pace of Life

Recently, I was introduced to the concept of micro-retirement, that is the idea of taking intentional, extended breaks from work, ranging from a few months

Contributing to the Supplementary Retirement Scheme (SRS)? Here’s What You Need To Know

It’s the ‘SRS rush’ season once again. You have just about 3 weeks left to contribute to your Supplementary Retirement Scheme (SRS) and enjoy tax

Why Reviewing Your Critical Illness Coverage Is the Smartest Year-End Move

Before year-end, if we had to pick just one critical financial planning action most people overlook, it would be this: Review and update your insurance

5 Responses

I value the article post. Thanks Again. Really Great. Chris Foos

Touche. Outstanding arguments. Keep up the great work. Rick Glasco

This is the right website for everyone who hopes to find out about this topic. Bud Hofmann

Awesome! Its genuinely remarkable paragraph, I have got much clear idea on the topic of from this paragraph. Enoch Susman

A big thank you for your article post. Really looking forward to read more. Fantastic. Harvey Popi