Karen Tang, CFP®: Certified Financial Planner in Singapore

The 4 Financial Management Habits That Successful People Practise Faithfully

What is financial planning? The typical response I get is “Buying insurance and investing to grow my money”. That is somewhat right.

You see, before we even delve into risk management or investment planning, the number one thing to determine in your financial planning is the health of your cash flow i.e. surplus or shortfall at the end of each month.

Cash flow is the life blood of any financial plan. When one’s cash flow is properly managed, the financial plan is adequately funded and this, in turn, ensures that goals can be met. Yes, scrutinising cash flow is not exactly an exciting task; it can at times be a ‘shock’ to the system, especially when there is uncontrolled spending. But this is precisely where prudent financial management starts.

Being disciplined in your cash outflow can reap good rewards now and in the future. Armed with greater clarity, you will have a better grasp of the bills and perhaps be able to set aside more savings so that you can pay off existing debts quicker or invest it in an annuity or retirement income plan for your retirement. And when you have that extra savings, indulging in something that you have always wanted would seem ‘justifiable’.

1. Budget Management

Personal cash flow management boils down to budgeting. By budgeting, we ensure that we do not spend beyond our monthly pay cheque. Budgeting may seem like hard work but once you get the hang of it, you will be glad that you have that discipline. There are cash flow and budgeting tools available online or through an app on the phone. I have developed a spreadsheet that automatically adds up the expenses that are fed in according to the frequency that they occur, for example, in the weekly, monthly, quarterly and yearly format.And if you have not set aside the required emergency fund – 3 to 6 months of monthly expenses; for a family with children, I would suggest more – then this is an apt exercise to help you get there. It is recommended that you review your budget and expenses every few months to ensure you are in the surplus zone.

2. Debt Management

There are short term debts like renovation and car loans and there are long term ones like mortgage loans. Short term debts, in particular, credit card debts need to be addressed immediately because the interest charged for overdues is a whopping 24% p.a.(in Singapore)! Yes, banks offer balance transfer facility but that is not a permanent solution. This points us back to good ol’ cash flow management.I have clients asking me whether it is advisable to repay all their outstanding car loan or redeem a portion of their mortgage. The answer would depend on the loan’s interest rate, the investment rate of return he or she is getting, cash flow, liquid assets etc.

Here are some pointers on managing debts:

- Know how much you owe and to which organisation or individual

- Pay your bills on time each month and in full

- Create a monthly bill payment calendar

- Set aside a monthly budget for your fixed and variable expenses (it is possible!)

- Get help early on if you are not successful in managing your debts

3. Risk Management

An unforeseen circumstance can suddenly throw you into deep financial turmoil. It can also derail your entire financial plan.There are four main ways to manage risk:

- Risk avoidance

- Risk transfer

- Risk reduction

- Risk retention

To negate huge financial losses, you have to understand the existing risks and then employ the most suitable risk management method.

Risk management lays the foundation of a solid financial plan. With the right type of insurance policies in place, you can achieve peace of mind, knowing that you and your loved ones are protected from unfortunate events. Be informed of your company’s benefits and know what government schemes or subsidies you can take advantage of. Most importantly, understand what you already have in place for yourself and your family.

4. Retirement Planning & Funding

According to a Nielsen survey commissioned by NTUC Income in February 2016, one in three working Singapore adults are not planning for their retirement.

- 25 per cent said they do not know when to start planning and how much to save to reach their retirement goal

- Saving for retirement only becomes a priority for those who are 36 years and above

- Retirement planning among the young is impeded by short and mid term financial commitments

- Retirees aged between 60 and 69 had saved only one-third of the funds they perceived to be sufficient for retirement

- Two-thirds of retirees said they wished they had started planning for retirement earlier, with 65 per cent indicating that they do not expect their savings to last throughout retirement. Their third most important source of retirement income comes from their family and children.

Not understanding savings options, don’t know where to start and how much to save are all excuses, in my opinion. Financial planning for retirement requires expertise from a qualified, registered financial planner; it is not something you want to figure out on your own.

Time and Compounding Interest

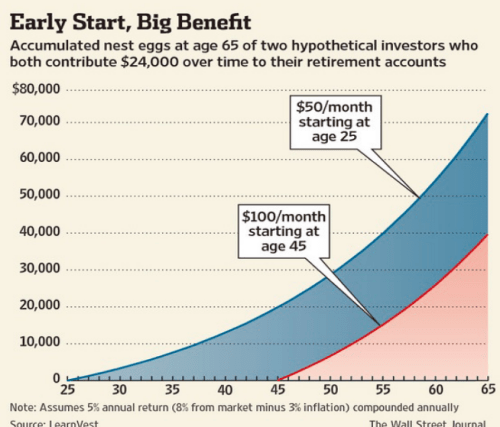

Time is of the essence when it comes to planning for retirement. Albert Einstein said “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

By planning for retirement early in your work life, you are taking advantage of the longer investment horizon that will allow you to reap the rewards of compounding interest. As investment returns are not guaranteed, this way, you will have time on your side to ride out the market fluctuations.

Graphically, this is what it means to save early for retirement versus twenty years later.

We all have dreams and goals. With determination, self discipline and a well thought through holistic financial plan, you can achieve them.

Let’s secure your financial future today!